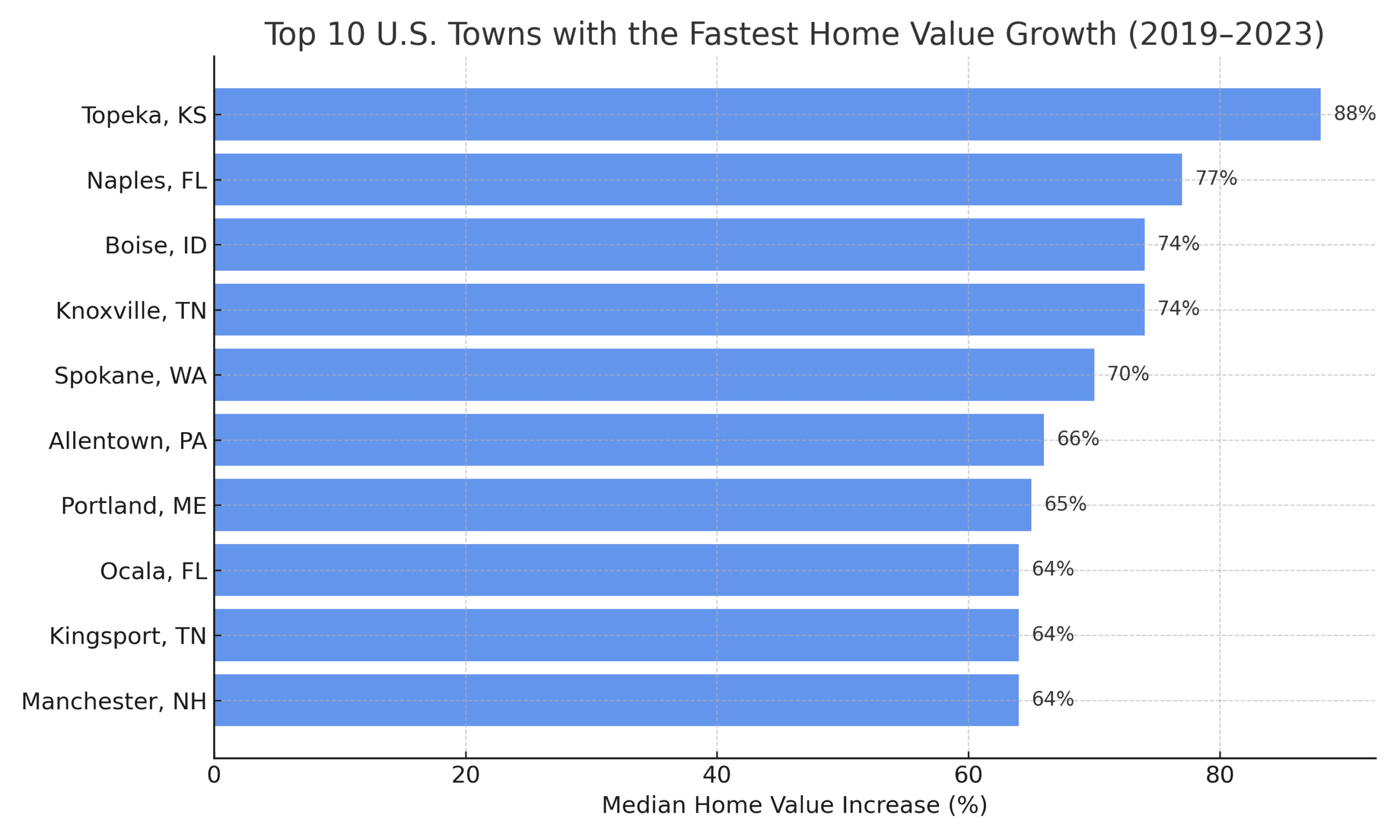

Top 10 U.S. Towns with the highest growth in home values since 2019

In our statistics series we’re continuing our search for interesting facts. And this time we’re taking a closer look at home prices. U.S. home prices have increased roughly 54% on average since 2019 but where in America have we experienced the highest increases? I’ll bet that some cities might surprise you.

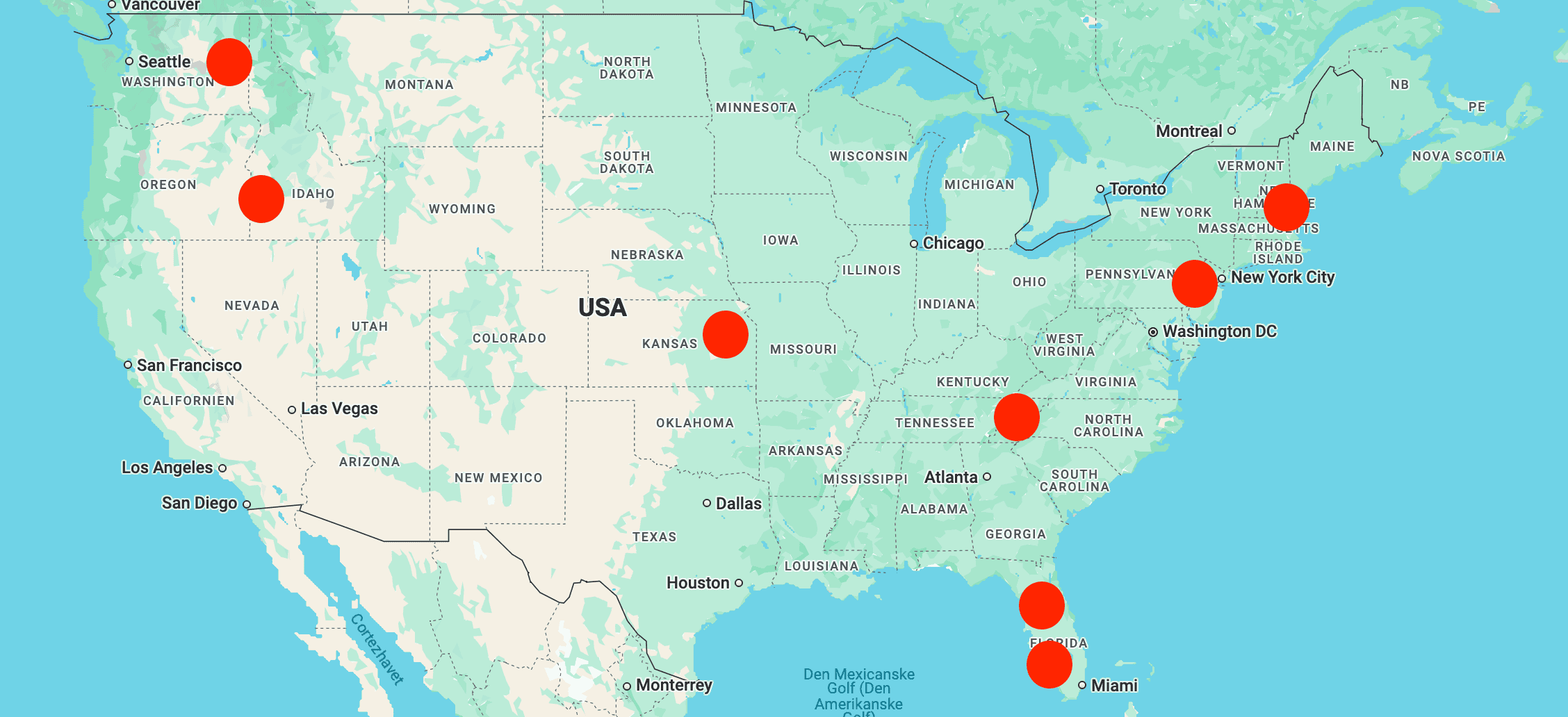

Americans have witnessed an unprecedented surge in home prices over the past few years. Since 2019, U.S. home prices have jumped by roughly 54% on average, with the early pandemic years seeing especially rapid gains. This boom has been even more pronounced in smaller cities and towns than in large metros. Remote work, historically low interest rates in 2020-2021, and buyers seeking more space or affordability all fueled soaring home values in many local markets. To spotlight these trends, I analyzed data on median home values from 2019 to the latest available estimates (through 2023), focusing on U.S. cities under 500,000 people. Below we present the ten towns that lead the nation in percentage increase in median home value since 2019, illustrating how widely the housing boom has been felt across the country.

Top 10 U.S. towns with the fastest-rising median home values (2019-2023)

Below are the top ten U.S. towns (population under 500,000) with the highest percentage growth in median home values since 2019, based on the increase in the median value of owner-occupied homes:

(Percent increases are estimates derived from the U.S. Census Bureau’s American Community Survey and other housing market sources, comparing 2019 values to roughly 2023. Only cities with fewer than 500,000 residents were considered, and population figures are from the 2020 Census. For context, nationally home values rose by ~54% in this period.)

A closer look at each city

- Topeka, Kansas – The capital of Kansas tops the list with a nearly 88% spike in home values since 2019. Long known for its affordable housing, Topeka saw home prices take off from a low base as buyers chased bargains in the Midwest. The typical home value here (around $100k in 2019) has almost nearly doubled, though it still remains modest compared to national averages. Local demand – along with interest from out-of-state remote workers seeking low-cost living – has propelled Topeka’s market upward, making it an unlikely leader in home price growth.

- Naples, Florida – This small Gulf Coast city, famous for its wealthy retirees and beachfront estates, has experienced a huge surge (~77%) in median home values. Already one of the priciest markets pre-2020, Naples saw an influx of high-end buyers during the pandemic, driving its median home price from under $1 million to roughly $1.7 million today. The area’s luxurious lifestyle and tax-friendly Florida location created feverish demand. Even as other markets cool, Naples’ prices remain elevated, reflecting how desirable and supply-constrained this enclave is for affluent homeowners.

- Boise City, Idaho – Boise became emblematic of the pandemic housing boom. Home values in Idaho’s capital jumped around 74% in just five years. Remote workers from expensive West Coast cities flocked to Boise for its relatively affordable houses, quality of life, and natural surroundings. This surge – Boise saw nearly 40% year-over-year gains at one point – transformed it from a quiet affordable market into one of the nation’s hottest. While price growth has cooled recently, Boise’s median home values remain far above their 2019 levels, underscoring how dramatically the city “leveled up” in the housing market.

- Knoxville, Tennessee – Knoxville’s home values have soared ~74% since 2019, making it one of the fastest-appreciating mid-sized cities. This university city is nestled near the Great Smoky Mountains and surrounded by lakes, an area that became highly attractive during the pandemic. Remote workers and retirees alike were drawn to Knoxville’s blend of outdoor recreation and moderate cost of living. The result: home prices skyrocketed – a trend fueled by Knoxville’s mix of natural amenities and steady local economy. It now stands as a prime example of how Sun Belt and Appalachian towns benefited from shifting housing preferences.

- Spokane, Washington – Eastern Washington’s largest city saw home values climb roughly 70% over the past few years. Spokane has been an affordable alternative for those priced out of Seattle, Portland, or California – offering a smaller-city lifestyle with access to nature. During the pandemic, many buyers from pricier West Coast markets looked inland, and Spokane’s limited housing supply couldn’t keep up. The result was rapid price escalation. Even accounting for recent market leveling, Spokane’s median home prices remain dramatically higher than in 2019. This boom reflects the broader trend of smaller cities outpacing big cities in price growth as people migrated to more affordable areas.

- Allentown, Pennsylvania – Pennsylvania’s third-largest city (population ~125k) has seen a two-thirds increase (~66%) in median home values since 2019. Allentown, part of the Lehigh Valley, was historically an industrial city with relatively low-cost housing. In recent years it has attracted buyers from New York and New Jersey seeking more space for the money. That spillover demand, combined with limited new construction, sent Allentown’s prices sharply upward. The city is undergoing a resurgence, and its housing costs – while still lower than nearby East Coast metros – are far above pre-2020 levels. Local officials have even called the price jumps “skyrocketing” and are looking to address affordability.

- Portland, Maine – New England’s Portland (not to be confused with Oregon) has quietly become one of America’s hottest small-city markets. Home values in Portland, ME are up roughly 65% since 2019. This seaside city offers historic charm and a high quality of life, drawing remote workers and buyers from Boston/New York who discovered Maine’s appeal during the pandemic. Housing supply in Portland is tight (it’s an older coastal city with limited room to build), so incoming demand pushed prices up quickly. For example, the price per square foot in Portland jumped about 77% from 2019 to 2023. Even as Maine’s market cools slightly, Portland remains much pricier than just a few years ago, reflecting its newfound popularity.

- Ocala, Florida – Ocala, a mid-sized city in central Florida, has seen home values climb around 64% since 2019. Known for its horse farms and rolling countryside, Ocala was long a relatively quiet market. That changed post-2019 as Florida’s overall housing boom reached inland cities. Ocala offered plenty of land and cheaper homes, attracting buyers from crowded South Florida and out of state. The area also benefited from job growth in distribution and healthcare. By 2022, the median home price in Ocala was roughly $190k, up from about $142k in 2019 (per ACS data) – a dramatic rise for this once affordable market. Ocala’s experience shows how even smaller, non-coastal Floridian cities were swept up in the pandemic-era real estate wave.

- Kingsport, Tennessee – Another Tennessee city makes the list: Kingsport (population ~55k) saw about a 63-64% increase in median home values over the period. Part of the “Tri-Cities” region in northeastern Tennessee, Kingsport’s housing was very inexpensive prior to 2020. Pandemic-era buyers looking for inexpensive property in scenic areas helped drive up prices. Proximity to the Appalachian Mountains and a low cost of living made Kingsport and its neighboring towns attractive. While home prices here are still low in absolute terms (the typical home is well under $300k), the relative growth has been among the nation’s highest. This mirrors a broader pattern of strong housing appreciation across many parts of Tennessee in recent years.

- Manchester, New Hampshire – New Hampshire’s largest city has experienced a home value jump of roughly 63% since 2019. Manchester became one of the hottest housing markets in the country during the pandemic, frequently topping monthly “market heat” indices. Buyers from Boston and other expensive markets poured into southern New Hampshire, seeking more affordable homes and taking advantage of New Hampshire’s lack of income tax. Statewide, New Hampshire’s median home prices rose over 70% from 2019 to 2024, and Manchester was at the center of that surge. The city’s attractive downtown, growing tech scene, and drivable commute to Boston made it a prime beneficiary of pandemic migration. Today, Manchester’s housing remains in high demand, though rising interest rates have tempered the frenzy compared to the early 2020s.

Each of these towns illustrates how widespread and intense the home price growth has been since 2019, far beyond just the usual suspect big cities. From the heartland (Kansas) to New England, the South, and the Mountain West, smaller communities nationwide experienced record housing value increases. While the market has begun to stabilize, these percentage gains underscore a new reality: many once-affordable towns are considerably pricier today than just a few years ago. Analysts caution that such growth rates are unlikely to continue unabated (and some areas have recently seen minor corrections). Nevertheless, the 2020-2022 housing boom has permanently shifted the pricing landscape in these communities. Homeowners in these top-10 towns have seen significant equity gains, while newcomers face higher barriers to entry. As the data shows, the effects of the pandemic-era housing market have been truly nationwide – redefining “affordable” in towns across America.

Methodology: Analysis is based on median home value data from the U.S. Census Bureau’s American Community Survey (ACS) 5-Year estimates and supported by other housing market research. Percent increases were calculated by comparing the 2015-2019 ACS median value for owner-occupied housing units to the latest available 5-year estimate (covering 2018-2022) for each city, supplemented with 2023 market findings for additional context. All percentage figures are rounded and approximate (denoted by “~”). Population figures are from the 2020 Decennial Census to ensure cities remained under 500,000 residents. Notably, external analyses (e.g., by ResiClub and Yahoo Finance) corroborate these trends – identifying many of the above cities (Topeka, Naples, Boise, etc.) as having the nation’s steepest pandemic-era home price increases. By focusing on smaller cities, our ranking highlights the local housing markets that outpaced the national average by a wide margin, demonstrating the diverse geography of America’s housing boom. Each cited source and dataset is linked for transparency, and all data reflects the best available estimates as of 2025.

Sources used in the analysis

- U.S. Census Bureau – American Community Survey (ACS) 5-Year Estimates

- Median home values (2015-2019 and 2018-2022 datasets)

- Population data (2020 Census)

- ResiClub / Yahoo Finance (Feb 2024) “These 20 housing markets have seen the biggest home price growth since 2019” Yahoo Finance source

- CoreLogic / S&P Case-Shiller Index (national trends) Referenced via CNBC reporting

- Zillow & Realtor.com Local Market Pages (for validation & historical values)

- Boston Globe / Portland Press Herald (for context on Portland, ME price growth)

- Knoxville News Sentinel. Regional analysis of home price growth in TN

- Tennessee Housing Development Agency Reports

- Spokane Association of Realtors Reports (SAR). Year-over-year median home value change reports

- New Hampshire Housing Market Reports. From New Hampshire Housing Finance Authority (NHHFA)

Allentown Morning Call / Lehigh Valley Economic Development. Local reporting on housing market trends