Top 10 U.S. towns with the most affordable homes

The statistics series continues with a bigger research into affordable homes. Previously we looked into where young people were most likely to be home owners and where home values have surged the most. It has uncovered an interesting topic of “affordability.” In what U.S. towns do we get to see the most affordable homes?

America’s smaller cities and towns often offer a winning combination of low housing costs and solid incomes, making homeownership attainable for local families. In this analysis, I identify the Top 10 U.S. towns (population under 500,000) with the most affordable homes. We used the latest 5-year American Community Survey data and other sources to compare median home values, median household incomes, average property tax burdens, and overall cost of living. The results span proud communities across the country – from the Rust Belt to the Heartland – where local pride runs high and residents enjoy a high quality of life without a high price tag.

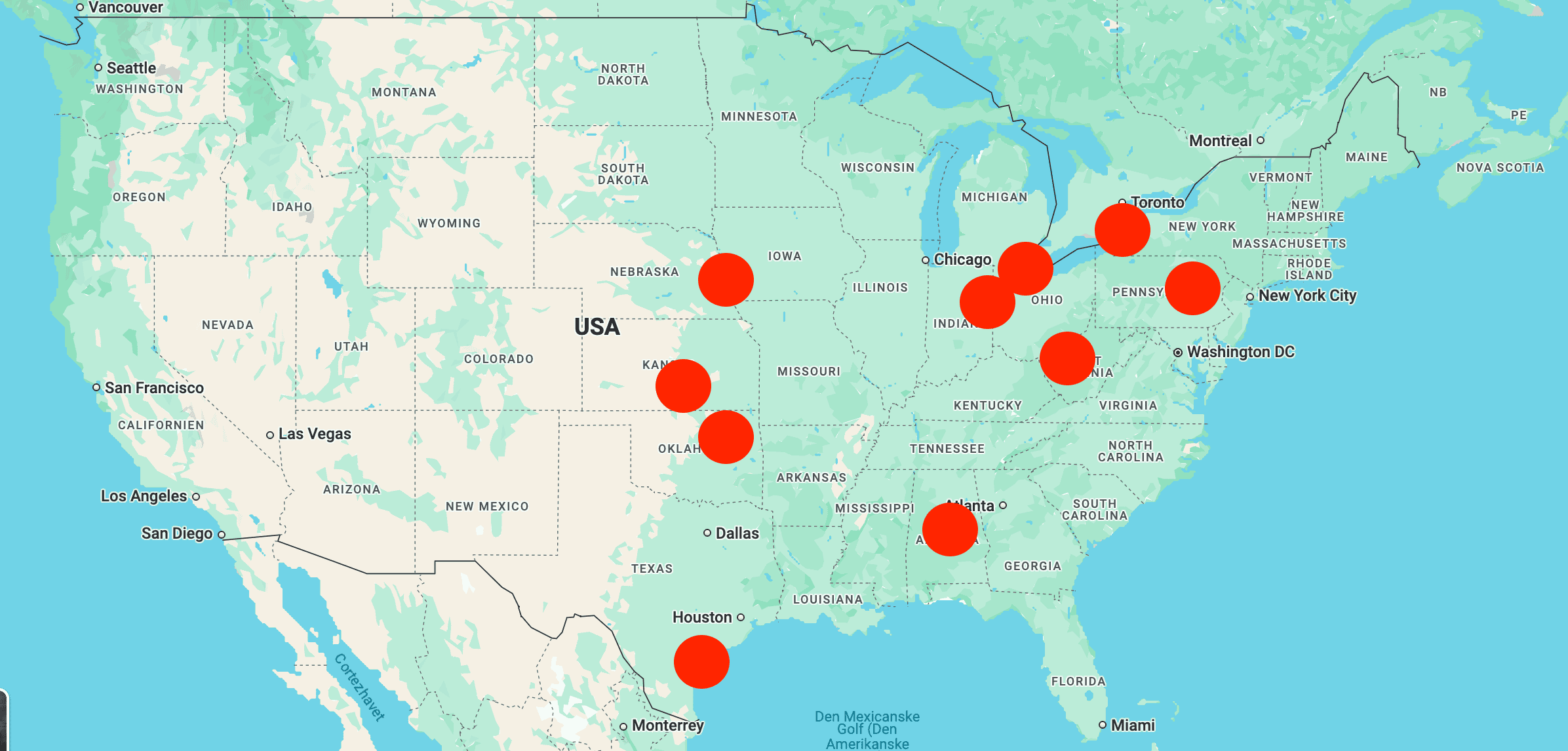

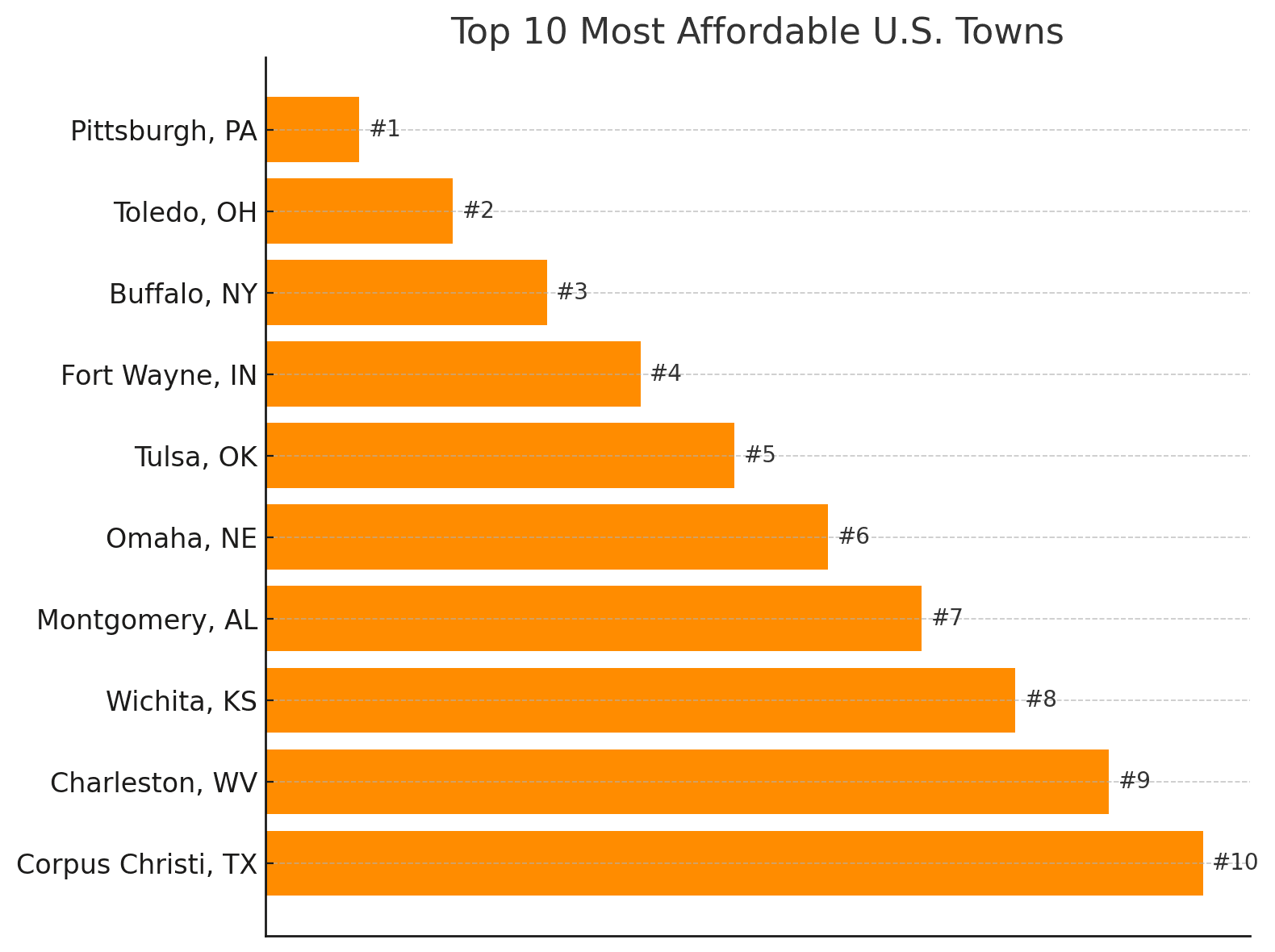

Top 10 most affordable home markets (towns < 500,000 population)

Below is a table of the top ten U.S. towns with the most affordable homes. These towns boast low median home values relative to median incomes, reasonable tax costs, and a cost of living well below the national average (index 100). Affordability is calculated as a composite of home value-to-income ratio, property tax rates, and cost of living indices (see Methodology).

(Cost of living index sourced from BestPlaces and similar indices; 100 = national average.)

A closer look at each town

- Pittsburgh, Pennsylvania – “The Steel City” tops our list, pairing moderate home prices with above-average incomes. The median home value in Pittsburgh is about $214,000 while the typical household earns roughly $66,000 a year. That healthy income, rooted in the city’s diversified economy (health care, tech, and education), helps keep housing very affordable for locals. Proud Pittsburghers celebrate their industrial heritage and champion their sports teams (Steelers, Penguins) – and they enjoy a cost of living about 8% below the U.S. average. Even with property taxes slightly higher than some Sunbelt towns, Pittsburgh’s strong incomes and reasonable home prices make it a place where locals can buy a home and still have room in the budget to bleed black and gold.

- Toledo, Ohio – Long known as the “Glass City” for its glass-making history, Toledo offers one of the lowest housing costs in the nation. The typical home is valued around just $108,000, while the median household income is about $46,000. That low price-to-income ratio – roughly 2.3 to 1 – means many families can comfortably afford a home. In fact, overall living costs in Toledo are about 22% below national averages. Residents take pride in their hometown’s blue-collar resilience and institutions like the Toledo Museum of Art and Mud Hens baseball. Property taxes in Ohio are moderate, but Toledo’s exceptionally low housing prices are the key to its affordability. Locals boast that in their city, “you get a lot of house for your money”, all while enjoying the friendly, hard-working community spirit.

- Buffalo, New York – Buffalo has remarkably affordable homes by New York standards, a point of pride for this revitalized Queen City. The median owner-occupied home is worth about $174,000 – less than a quarter of home values downstate – and median household income is around $46,500. While incomes aren’t especially high, housing costs are so low that many Buffalonians achieve homeownership; the city’s price-to-income ratio is roughly 3.7, and housing expenses remain well below the U.S. average. Buffalonians are famously proud (just ask any Bills or Sabres fan) and have embraced a resurgence of their waterfront and neighborhoods. They do face higher property taxes common in Upstate New York, but even factoring that in, Buffalo’s overall cost of living sits about 8% under the national norm. The city’s nickname “City of Good Neighbors” rings true – here, community spirit is strong and owning a home doesn’t require breaking the bank.

- Fort Wayne, Indiana – This Hoosier city combines a low Midwest cost of living with steady Midwestern incomes. Fort Wayne’s median home value is around $200,000, against a median household income of about $57,000. That yields a very manageable home value-to-income ratio near 3.5. But what really sets Fort Wayne apart is its inexpensive market for everyday expenses – the city’s cost of living is nearly 18% below the U.S. average. Indiana’s property taxes are capped (around 1% effective for owner-occupied homes), which keeps homeownership costs down as well. Fort Wayne residents brim with local pride, whether cheering on the TinCaps at Parkview Field or recalling the city’s origins as a frontier fort. With affordable new subdivisions and historic neighborhoods alike, Fort Wayne offers a chance to buy a spacious home on a modest salary, making it one of America’s most budget-friendly places to put down roots.

- Tulsa, Oklahoma – Oklahoma’s second-largest city offers big-city amenities with a small-city affordability. Tulsa’s median home price is about $189,600, and the median household earns roughly $58,400, keeping the housing cost-to-income multiple around 3.2. Additionally, Tulsa enjoys low taxes (Oklahoma has no state property tax and reasonable local rates around 1%), and an overall cost of living ~15% below national levels. Residents are fiercely proud of Tulsa’s unique blend of Art Deco architecture, rich Native American and oil boom history, and blossoming arts scene. From the Guthrie Green to the Gathering Place park, Tulsa invests in quality of life – and yet remains very affordable. Locals often note that salaries stretch further here: young families can afford houses with yards, and entrepreneurs find Tulsa a low-cost base to start businesses. High livability and low costs make Tulsa an easy choice for this top 10 list.

- Omaha, Nebraska – Omaha stands out as an affordable heartland hub where strong incomes meet reasonable home prices. The median Omaha household brings in about $71,000 per year, while the median home value is roughly $255,500. That ratio (around 3.6) is better than many metros its size. More importantly, expenses across the board – from groceries to healthcare – are modest; Omaha’s cost of living index is about 9% below the U.S. average. Homeowners benefit from Nebraska’s stable housing market, though property taxes are on the higher side (the state average effective tax rate ~1.5-2%). Omaha’s citizens are deeply proud of their city’s pioneer heritage and modern achievements (Fortune 500 companies, a world-class zoo, and the College World Series each summer). Neighborhoods are filled with century-old homes and new developments alike, often much more affordable than comparable homes on the coasts. In Omaha, a family earning the median income can comfortably afford the median house – a hallmark of true housing affordability.

- Montgomery, Alabama – The capital of Alabama offers Southern charm at bargain prices. Montgomery’s median home value is about $158,500, while the median household income is around $57,300. That yields a home value-to-income ratio of approximately 2.8, one of the lowest in this top 10. Alabama’s famously low property taxes (effective rates often under 0.5%) significantly reduce homeowner costs – a point of pride for local advocates of homeownership. Montgomery’s overall cost of living is over 20% below the national average, making everything from housing to groceries easy on the wallet. Locals are proud of Montgomery’s rich history – from the Civil War to the Civil Rights Movement – and its ongoing cultural renaissance. They’ll also proudly tell you that in Montgomery, you can own a piece of the American dream for far less than in many other capital cities. In this “Cradle of the Confederacy” turned modern mini-metro, affordable homes line oak-shaded streets, and new homeowners are welcomed with true Southern hospitality.

- Wichita, Kansas – Wichita is nicknamed the “Air Capital of the World” for its aviation industry, but it could also be called an air-conditioned oasis of affordability. The median Wichita home costs roughly $150,000 (well under the national average), and median household income is around $56,000, keeping the price-to-income ratio near 2.7. Day-to-day living is cheap too – Wichita’s cost of living score is about 17% below the U.S. figure. Kansans enjoy relatively low property taxes on moderately priced homes, and no state income tax on food, which further helps budgets. Wichita residents are proud of their city’s blend of Western heritage and high-tech industry – it’s not uncommon to see cowboy boots and engineer boots in the same downtown. From the bustling Old Town entertainment district to the Delano neighborhood’s unique shops, Wichita offers big-city conveniences without big-city prices. For locals, homeownership is attainable on almost any reasonable income, and that pride of ownership shines through in well-kept neighborhoods citywide.

- Charleston, West Virginia – West Virginia’s capital city combines Appalachian hospitality with inexpensive housing. Charleston’s median home value is about $187,300, and its median household income is around $64,500 – a very favorable mix (ratio ~2.9) aided by recent growth in higher-paying jobs in the region. Notably, Charleston’s median income is about 10% above the state’s average, while its home prices remain in line with the state, boosting affordability. The cost of living is nearly 20% below the U.S. norm, with housing costs in particular ~40% lower than average . West Virginia homeowners benefit from some of the lowest property tax burdens in the country (effective rates around 0.5%), so owning a home in Charleston comes with very low carrying costs. Charleston residents brim with state pride – from cheering on the WVU Mountaineers to hosting the annual Charleston Sternwheel Regatta on the Kanawha River. Surrounded by scenic hills, Charleston proves that even a state capital can feel like a close-knit town, where affordable homes and a strong community go hand in hand.

- Corpus Christi, Texas – Rounding out the list is this “Sparkling City by the Sea,” where coastal living doesn’t cost a fortune. Corpus Christi’s median home value is about $197,100 , and the median household income is roughly $66,300, keeping the median house price at just 3 times the typical income – very affordable for a beachside city. Overall, Corpus Christi’s cost of living is ~16% below national levels, with housing about 21% cheaper than average. Texas has no state income tax, which, combined with moderate home prices, means families can allocate more of their earnings to buying a home (though Texas’s higher property tax rates, ~2% effective, are something to budget for). Corpus residents are proud of their city’s rich Tejano culture, naval base and port (one of the nation’s busiest), and easy access to the Gulf’s fishing and boating. They often boast that you can spend the morning at the beach and the afternoon in your affordable dream home. With its blend of sun, sea, and savings, Corpus Christi exemplifies affordable coastal living at its finest.

Methodology

To determine the towns with the most affordable homes, I analyzed data from the latest available 5-year American Community Survey (ACS) and other reputable sources. Our primary metrics were:

- Median Home Value (owner-occupied housing) and Median Household Income for each town, from ACS 2018-2022 estimates. These indicate how home prices compare to local incomes. Towns where median home values were low relative to median incomes scored well (a lower price-to-income ratio signifies greater affordability).

- Property Tax Burden, using median real estate taxes (ACS) and state/local tax rate data. I factored in effective property tax rates, since areas with very high taxes can diminish affordability even if home prices are low. For example, Alabama and West Virginia have some of the lowest property tax rates, boosting those towns’ rankings, whereas Upstate New York’s higher taxes slightly offset its cheap housing.

- Overall Cost of Living Index for each town, compiled from sources like the BestPlaces Cost of Living Index and U.S. Bureau of Economic Analysis data. This index (with 100 as the U.S. average) accounts for expenses like housing, utilities, food, healthcare, and transportation. Towns with an index well below 100 were given a boost in our rankings. For instance, many of the top 10 towns have cost of living scores in the 80s or even 70s (meaning 20-30% cheaper than the nation).

Only U.S. towns and cities with populations under 500,000 were considered, to focus on small and mid-sized communities. We calculated a composite “Affordability Score” for each candidate town by weighing the home value-to-income ratio most heavily (since housing price vs. income is the core of affordability), and then adjusting for property tax and cost-of-living differences. Data on population and incomes were cross-verified with 2020 Census figures and 2021-2023 ACS updates for accuracy.

All statistics are the latest available as of 2025. By using multi-year ACS data, we ensured coverage of smaller towns that may not appear in 1-year surveys. It’s important to note that affordability does not solely mean “cheap housing” – we looked for communities where local incomes comfortably support local home prices. Each of the top 10 towns combines accessible homeownership opportunities with a reasonable cost of living and storied local pride. Sources for data include the U.S. Census Bureau (ACS), BestPlaces cost of living index reports , and state tax rate data , among others, to ensure a well-rounded analysis of what “affordable” truly means in each community.

Sources

- U.S. Census Bureau – American Community Survey (ACS) 5-Year Estimates (2018–2022)

-

- Median household income

-

- Median home value

-

- Real estate taxes paid

-

- Population figures

- BestPlaces Cost of Living Index (2024 data)

- Tax Foundation – Property Tax Rates by State

- State and Local Government Sources

-

- Cross-verification of local property tax practices (e.g., Indiana’s 1% cap, Alabama’s low millage rates)

- U.S. Bureau of Economic Analysis (BEA)