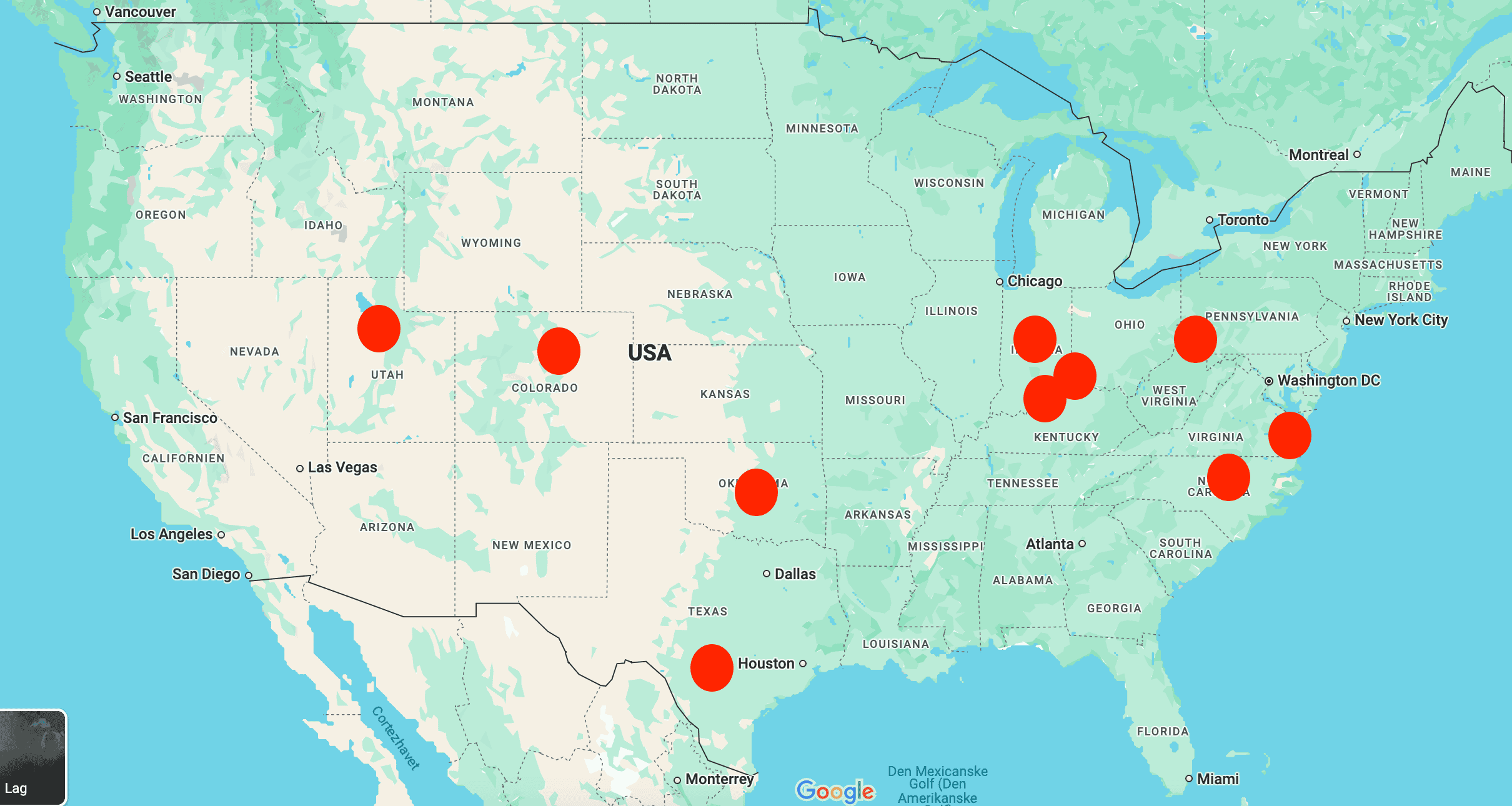

These 10 U.S. cities have the most young homeowners in 2025

While housing affordability remains a challenge across the U.S., a new look at national data shows that in some cities, young people are still becoming homeowners in large numbers. Here's a ranking of the 10 metro areas with the highest share of mortgage holders under 30.

In many countries young people are staying renters longer and buying homes later. In the U.S., that trend has been similar, with rising home prices and interest rates pushing the average first-time buyer well into their 30s.

But as I learned: That’s not the full story.

Digging into recent housing data, I found a number of U.S. cities where a surprising share of homeowners are under the age of 30. In many of these places, affordability and a strong local economy are giving younger adults the chance to buy homes much earlier than average.

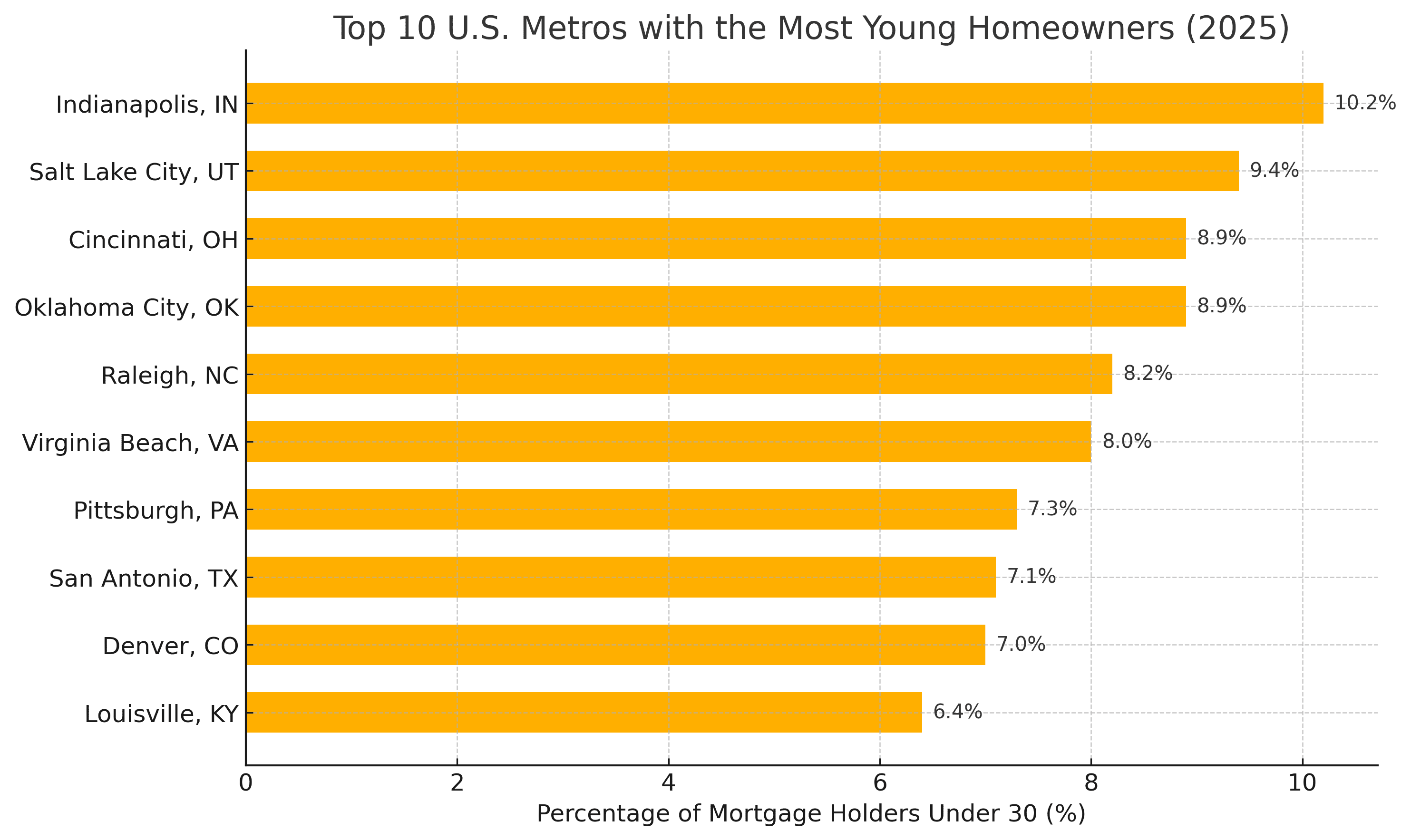

Below is a list of ten metro areas with the highest share of mortgage holders under 30, based on new data from LendingTree.

Top 10 U.S. metros with the most mortgage holders under 30

A closer look at the metros

- Indianapolis, Indiana

Leading the list, Indianapolis has become a stronghold for young homeowners. With relatively low housing prices and a strong job market, it offers one of the best combinations of affordability and opportunity in the Midwest. (LendingTree) - Salt Lake City, Utah

This mountain metro combines a booming economy with scenic living. Many young professionals are finding that Salt Lake’s balance of wages and home prices makes early homeownership possible. (LendingTree) - Cincinnati, Ohio

Cincinnati pairs a solid economy with reasonably priced homes. Neighborhoods throughout the city offer good value for first-time buyers, and nearly 9% of mortgage holders are under 30. (LendingTree) - Oklahoma City, Oklahoma

With wide open space and a steady employment base, Oklahoma City is drawing in young adults looking to settle down earlier than average. (LendingTree) - Raleigh, North Carolina

Raleigh is one of the strongest tech-driven economies in the U.S., and young homeowners are following. Education, job growth, and accessible housing options all help bring buyers into the market before 30. (LendingTree) - Virginia Beach, Virginia

With a steady mix of military and civilian employment, Virginia Beach offers economic stability and affordable homes, making it an attractive choice for young people entering the market. (LendingTree) - Pittsburgh, Pennsylvania

Formerly an industrial stronghold, Pittsburgh has reinvented itself with healthcare and tech jobs. That economic growth, combined with low housing prices, is helping more young adults buy homes. (LendingTree) - San Antonio, Texas

San Antonio offers both charm and affordability. While Austin has become more expensive, San Antonio has stayed relatively affordable, giving younger residents a better shot at homeownership. (LendingTree) - Denver, Colorado

Though housing prices are higher in Denver, so are wages and lifestyle perks. The fact that so many young adults are still managing to buy homes here is a sign of strong economic participation. (LendingTree) - Louisville, Kentucky

Louisville rounds out the list with 6.4% of its mortgage holders under 30. The city’s manageable housing prices and improving job market make it a realistic option for younger buyers. (LendingTree)

How this research was conducted

This ranking is based on LendingTree’s Q4 2024 analysis of mortgage holders by age group across the 50 largest U.S. metropolitan areas. The data reflects the share of people under 30 who hold active mortgages in each metro. Only cities with publicly available, verifiable data were included.

Each city was ranked by the percentage of under-30 mortgage holders, with figures rounded to the nearest tenth. No extrapolated or estimated numbers were used.

Full dataset and methodology: LendingTree Report

——

While homeownership is becoming more difficult for young adults in many parts of the world, this list shows that in some U.S. cities, it’s still very much possible. Places like Indianapolis, Salt Lake City, and Cincinnati prove that affordability and opportunity can still come together — even before age 30.

For anyone watching housing trends, these metros are worth keeping an eye on.